FAQ

We are working on a solution to provide RV insurance in Canada that allows you to legally rent your RV on sharing sites like Outdoorsy.

Most RV insurance companies offer specific types of coverage for specific types of RVs — for specific types of RV owners. Yeesh. But Roamly’s different. We offer all types of RV insurance!

Check it out.

RV insurance for the Weekend Warrior

If you use your motorhome for special trips — as opposed to living in yours for more than 6 months of the year — a standard personal RV policy is right up your alley. Here’s what they typically look like.

Liability protection

There are 2 types of liability insurance.

1. Property damage liability covers the other person if you’re found at-fault for damaging their property (vehicle, fence, garage door, etc.).

2. Bodily injury liability covers the other person if you’re found at-fault for their injury — be it a driver or pedestrian.

Also note, liability protection is required in pretty much every state.

Comprehensive coverage

Comprehensive covers damage to your RV that’s non-collision-related. Things like hail, theft, and vandalism.

Collision coverage

This helps pay for repairs to your RV if it collides with another vehicle or object. And that’s regardless of fault.

Medical payments coverage

If you’re in an accident, this one will foot your medical bills for you or passengers.

Uninsured/underinsured motorist coverage

These step in if an at-fault driver doesn’t have enough insurance (or no insurance) to cover your repairs or medical bills.

Roadside assistance

If your RV’s kaput, roadside assistance is there with tows, fuel delivery, jumpstarts, and more.

Coverage for RV owners renting out their RV

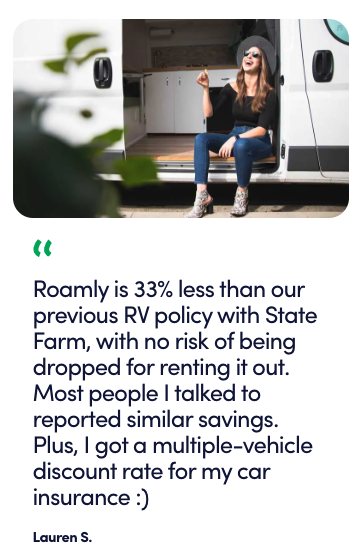

Many RV insurers drop your policy altogether if you rent out your motorhome or camper. Not Roamly. If you’re renting your RV on sites like Outdoorsy, you’ll still be covered by your Roamly policy.

Commercial RV insurance

If you rent out three or more RVs regularly, consider a commercial policy. It covers all the associated risks with running a business. Roamly lowers rates by only insuring the time between rentals, since your customers pay for insurance during the rental period.

Plus, Wheelbase Pro and Outdoorsy offer built-in insurance during the rental period — at no added cost. That way, you’re financially protected front to back.

At this time Roamly’s personal RV policies do two amazing things: they offer excellent insurance for RV owners for your everyday use (not during the rental period), and they also allow you to rent out your RVs without the fear of having your coverage dropped for renting. Pretty good, right?

But what about insurance for renters during the rental period?

If you choose to rent out less than five RVs, the easiest way to offer RV insurance for your renters is through our friends at Outdoorsy. Through Outdoorsy, renters purchase one of the insurance protection packages that covers them during their rental. Outdoorsy make the process easy and convenient, including verifying the renters before you exchange keys so you get peace of mind.

If you plan to rent out five or more RVs as more of a full-fledged rental business, then it may be easiest to sign up for Wheelbase Pro. It’s a free online rental management tool through which you can offer insurance to your renters that they pay for. The insurance packages and convenient process are similar to Outdoorsy’s. Another benefit of Wheelbase Pro is that it allows you to accept direct bookings from renters.

It’s easy to get better RV insurance through Roamly. Start by answering a few simple questions online at Roamly.com, like how many vehicles you want to cover. There aren’t too many questions, we promise. After completing these questions you’ll see an initial online insurance quote. Then one of our friendly US-based agents will want to confirm details over the phone to ensure you get the best coverage and price for your needs. After receiving a final quote from your dedicated agent, they’ll help you quickly complete the purchase of your new policy (insurance people call it ‘binding’). Once finalized, you’ll conveniently receive your official policy documents via email so you can be off and running.

Yes! With Roamly commercial and personal policies you can safely rent your RV on marketplaces like Outdoorsy without losing coverage or worrying about loopholes. And with Outdoorsy’s extra rental-period insurance, your RV stays covered from start to finish with no gaps or extra costs you don’t need. Welcome to a better world of RV insurance.

Absolutely. You can switch insurance companies at any time—even if you just renewed your policy with another insurance company. And when you cancel with an insurer, you get a refund for the money you paid in advance. And if you canceled to switch to Roamly, your life just got a lot easier.

Roamly Insurance Group, LLC (“Roamly”) is a licensed general agent for affiliated and non-affiliated insurance companies. Roamly is licensed as an agency in all states in which products are offered. Availability and qualification for coverage, terms, rates, and discounts may vary by jurisdiction. We do not in any way imply that the materials on the site or products are available in jurisdictions in which we are not licensed to do business or that we are soliciting business in any such jurisdiction. Coverage under your insurance policy is subject to the terms and conditions of that policy and is ultimately the decision of the buyer.

Policies provided by Roamly are underwritten by Spinnaker Insurance Company, Safeco Insurance, Foremost Insurance Company, National General Insurance, Allstate Insurance Company, Voyager Indemnity Insurance Company, or HIPPO Insurance Services.